Can I "Marie Kondo" My Money?

An experiment in applying the "KonMari" method to finances. Steps 1-3.

Welcome to my new experiment! Rub your hands together and muah-ha-ha!

It’s the new year and maybe you’re thinking about a “new you” too?

My area of focus this year is numerical. I’m getting more in the numbers. Exacting, measuring, calculating. As a verbal-minded person, this is something I tend to neglect, but not anymore!

Instead of what would Jesus do, I’m asking, What would Marie Kondo do… in terms of my bank accounts.

Can I “Marie Kondo” my finances?

Does this bank fee spark joy?

“Tidying can transform your life… When you put your house [money] in order, you put your affairs and your past in order too. As a result, you can see quite clearly what you need in life and what you don’t, and what you should and shouldn’t do.” — Marie Kondo, The Life-Changing Magic of Tidying Up.”

*Now, before I proceed, this post is about organizing money. It’s not about making money.

**If you’re triggered by women with money, perhaps consider stopping right here.

***Also, if you have a loved one managing your finances for you (without financially abusing you)—YOU ARE BLESSED! Rejoice! Go and thank that special person right now!

The Problem

I’ll confess right now—my finances are a mess. A HOT MESS.

Before you get sad for me, just know that I made my own problems. Hello, ADHD brain! However, thankfully, my problems aren’t really about budgeting or overspending. I have enough money coming in, I just can’t monitor it well, and it stresses me out A LOT to keep track of everything. My finances feel super disorganized and time-consuming. Do yours?

Mine are such a mess that I’ll avoid looking at the mess from time to time and then feel even more overwhelmed when life forces me to review what I’ve been avoiding.

Sometimes I can’t find line items when I need them. I’m also vulnerable to duplicate charges, extra fees, false charges, fraud, and inefficiencies, plus the general feeling of being out of control.

I don’t know how much my monthly expenses exactly are or how much I’m earning per month. I intuitively sense that everything is ok, or I sense that I need more money and things are not ok…

For example, I constantly subscribe and unsubscribe from Hulu and HBO Max, depending on how I’m feeling about my account balances. Nothing is precise. Everything is emotion and not math.

At the end of the year, I remove whatever money I didn’t spend and invest it. Sometimes I also make random investments during the year if I sense I’ve had a boon or a windfall. Again, everything is by eyeball and not by exact figure. I’m constantly guessing and approximating… And I leave cushion balances in my accounts and have things set up to trigger savings to cover things I don’t cover, so I’m probably losing out on interest payments I could get if I had a more precise handle on the cash I actually needed to keep as cash.

The whole “system” isn’t a system at all and feels precarious, like it could topple over by accident or by negligence or from a recession, ahem.

Deep Breath

A friend confessed to me a few years ago that her finances were a mess. The situation was giving her tremendous anxiety. I could seriously relate. It’s embarrassing to feel disorganized about something so important to our survival and to society. We were both “grown women” in our middle age, with excellent educations and decent savings. She was even a high-earner, with a job and salary anyone would envy.

In her case, her father is an accountant and very tax savvy. So I asked her why she didn’t ask her dad for help. Her answer—she didn’t want to face his judgment. She didn’t want him to know. I could also relate.

It’s embarrassing to feel disorganized about something so important to our survival and to society. We know our finances shouldn’t resemble a garage on the TV show Hoarders, but this fee-creep or credit card-creep, or whatever your creep-situation is, can happen to anyone. Not to mention the fact that fees sometimes increase without us knowing, or credit card companies change the terms and we miss the email or the fine print.

Our finances shouldn’t resemble a garage on the TV show Hoarders.

Even writing this publicly feels tantamount to confessing one’s alcoholism to the Internet. We aren’t supposed to be haphazard with money. We’re supposed to be good custodians of wealth. We’re supposed to be responsible parents, saving for our children’s future. We’re supposed to know how much money we have. Right?

But many of us don’t.

I know I’m not alone. How many other people are eyeballing everything? Probably a lot. And it’s not like it doesn’t work. It works, but for how long, I don’t know…

At the time of this conversation, I sort of organized my finances and invested some accumulated cash that was wasting away, but what I didn’t know then is that my halfway approach would result in, well, halfway results.

Likewise, I tried the habit of #FinanceFriday. Every Friday I set aside hours to tackle financial stuff, but since I hadn’t done enough groundwork, these Fridays were mostly spent on urgent, quick tasks instead of important, more time-consuming tasks… and they left me feeling spent… pun intended.

Currently, I worry that if anything happened to me, no one in my home would even know where to begin. They’d find a confusing financial quagmire to unravel. I need to organize everything FOR REAL for this reason alone.

Can Marie Kondo rescue me?

Will tidying my finances create life-changing magic?

A Spark

While reading Tony Robbins’ book, Money, in hopes that it would help me organize my finances, I stumbled upon this quote he included by Marcus Aurelius:

“Victory lies in the organization of the non-obvious.”

I thought, ok, what is the “non-obvious” part of my finances? I couldn’t figure it out, so in a roundabout way, I asked Twitter for ideas.

A stranger, Borealman63, responded:

“Start organizing something you think is already organized, but organize it better. Like say, the layout of furniture in a room. Then transfer that thinking to more complex things or ideas.”

Huh.

I am good at organizing rooms. My Airbnbs are immaculately organized.

Why? Marie Kondo.

YES! I needed to apply Marie Kondo to my bank accounts!

Who is Marie Kondo?

If you aren’t familiar with Marie Kondo, what sock drawer have you been living in?

Here is a brief introduction: she’s a bestselling author, a world-renowned tidier, and a petite Japanese woman obsessed with decluttering. She has a Netflix series, home product lines, courses, books, and a 6-step tidying process called the “KonMari Method.”

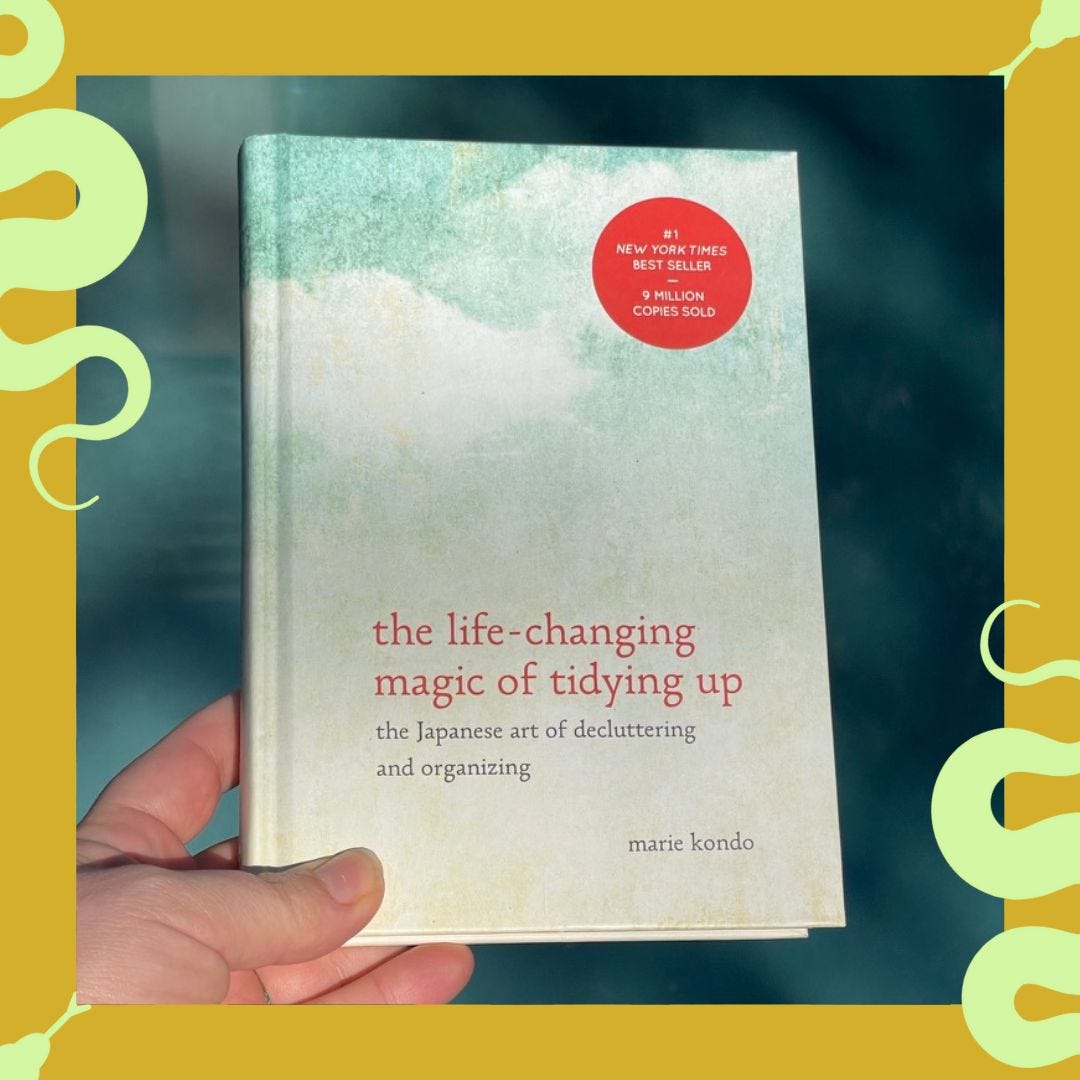

Her bestselling book, The Life Changing Magic of Tidying Up, is super short and highly entertaining.

I listened to it on audiobook shortly after its release, and I remember playing parts aloud for my boyfriend and us laughing HYSTERICALLY because certain sections sounded utterly ridiculous. For example, she talks about the spirit of socks and talking to household objects. Like, how will your socks feel all balled up? Hmm?

She recommends thanking your clothes daily for keeping you warm and she sent a text message to her old cell phone, thanking it for its service before switching to a new cell phone.

“Express your appreciation to every item that supported you during the day… When you treat your belongings well, they will always respond in kind.” — Marie Kondo, The Life-Changing Magic of Tidying Up.

She has a unique way of saying things, but umm... Her method WORKS.

I used the KonMari method recently to clean and organize a very cluttered house that belonged to my parents, even secretly used it on my parents, being like “BUT DOES THIS BROKEN STOOL FROM 1987 REALLY SPARK JOY???”

However, it never dawned on me to apply this method to other areas of my life until now. Thank you, Twitter.

Let’s get into the method.

The KonMari Method:

The KonMari Method principles:

Gather

Discard

Store

Tidying isn’t listed because Kondo believes once you do her process, you will never tidy again; you will simply put things back in their correct homes.

She recommends a 6-step process:

Commit yourself to the process.

Visualize/imagine your ideal lifestyle.

Discard items that do not spark joy.

Tidy by category, not by location.

Follow the right order.

Ask yourself if items spark joy.

Applying KonMari to My Money Mess

My financial mess is more than most probably, and after reading this, perhaps you will consider me crazy. But remember, I am a writer, not an MBA holder!

Yet, I love being my own boss and being an entrepreneur. I quit working for the State Department, though I was doing well and getting promoted every year, for many reasons, but in part because I just couldn’t stand having rotating bosses that ran my life. I like to run my life.

So I must learn to run my own finances as well as my sentences.

Currently, my mess involves:

— 25 different accounts.

Yeah, that’s really all you need to know. I’m crazy.

Counting them and keeping track of passwords is a challenge that I must, must, must simplify.

Accounts include:

Credit Cards

Debit Cards

Brokerage accounts

Payment apps (like Zelle, paypal, cashapp)

My own trading/investment accounts

Crypto holdings

401k from the State Department

Mortgages

Car loan

(Thankfully I don’t own a mess of NFTs… but if you do, my sympathy for you…)

My situation is further complicated because we used to live in Canada and I still have a business there, so I have duplicate accounts in Canada in CAD and accounts in the US.

I also need separate accounts for my different Airbnbs, which is necessary for tax-reporting/P&L reasons.

Finally, I have a bunch of different credit cards that offer different perks for different types of spending, and I’ve got two mortgages, one on my home, and one on a rental property.

And, I over-complicated things because I enjoy split-testing. For example, I have two trading apps because I wanted to try both.

But it’s all too much.

I MUST DECLUTTER!

What would Marie Condo do?

First, I’ll ask ChatGPT (cause why not?):

The bottom paragraph is exactly what I want to do:

“The goal of the KonMari method is to create a sense of order and calm in your physical and financial spaces, so take the time to reflect on what brings you joy and what does not, and focus on keeping only those things that truly matter to you and your business.” — ChatGPT

The rest of this answer doesn’t really help that much because my issue is not paper or storing papers, though I probably need some sort of automated bookkeeping system.

What would you do?

Steps 1-3

Let’s begin.

Maybe you want to do this along with me and think about your own finances?

Step 1: Commit yourself to tidying up your finances. The KonMari Method™ is not a quick fix for a messy room or a once-in-a-while approach to tidying. ...

I am committed. I am DOING THIS.

Step 2: Imagine Your Ideal Lifestyle. ...

My ideal lifestyle is to have things as automated and passive as possible.

Instead of feeling confused and overwhelmed, I feel masterful and in control.

Tax time is easy for me!

I don’t have to spend a lot of time digging through things because I know exactly where everything is.

Fraud never happens to me, because I am in control!

I don’t pay unnecessary fees or get charged double!

Step 3: Finish Discarding First. ...

Hmmm… Perhaps the first step is to discard the accounts/services with unnecessary fees?

Also, go through each account and eliminate subscriptions and costs I don’t enjoy or use.

Hell, I need to go through and see what fees I’m even being charged for each account, for all I know, the fees may have changed.

Let go of things that bring stress or guilt

So maybe I should let go of some credit cards because they’re bringing added stress, so even if I’m getting a 2% return on spending, perhaps it isn’t worth having an extra account to check.

But wait, first, I must gather everything by category.

She also writes that I need to aim for perfection. Doing a little each day won’t work. I must do this in as big a go as possible. Or at least do an entire category in one day. Can I block off enough time for this? Yes, I can. Why? Because I’m committed, ah ha! Step one.

What else could rule three mean?

We need to also consider some of Marie Kondo’s other tips like “One Category At A Time.” and “Work by category and not by location.”

Would one category be a bank account? Or a type of spending? Tax deductions vs non-tax deductible spending?

She also suggests making the process “personal, emotional, and meaningful.”

Emphasizing aesthetics might be useful. I enjoy doing things more when the area is beautiful. Maybe I could make a custom Notion spread or something colorful to help me better monitor things, though that might add unnecessary complexity….

And I know I need to “reduce friction,” like too many accounts and all these logins, etc.

Next Steps

Let’s stop here and I’m going to gather everything together and tackle step #3— Discarding. Then I’ll report back.

Please, please, please let me know if you have any helpful suggestions for me!

Would you consider using this process on your finances?

Have you read Marie Kondo’s books or watched her show?

Did you make any new year/new me type plans? Let me know in the comments!

I need this in my life right now. I'm all over the place. I bought a planner though, so hopefully that will help. But having a hobby in trading cards is definitely not easy on the budget.

Fantastic!